There’s a saying that goes something like “the market can stay irrational longer than you can remain solvent.” What does that mean? It means we need to be extra careful when trading because the market is unpredictable.

But there are patterns that help predict where prices will go—and those patterns are called chart patterns. These chart patterns can help you identify potential trends and opportunities to trade cryptocurrencies.

In this article, I’ll show you what I think is one of the best chart patterns (at least in my humble opinion) for trading crypto: the Dark Cloud Cover pattern.

What Is a Dark Cloud Cover?

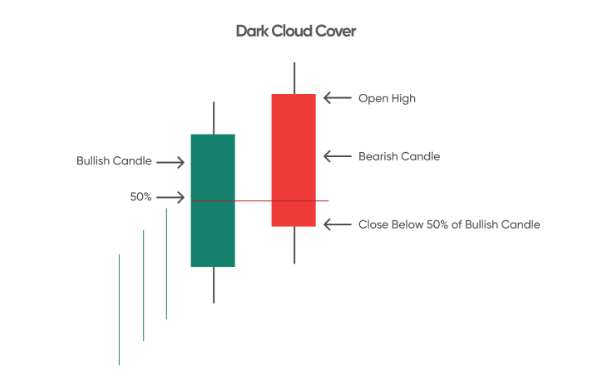

A dark cloud cover is a candlestick pattern that occurs when a bearish price action reversal follows an uptrend, or vice versa. A dark cloud cover pattern has several criteria, which you need to know if you want to trade it successfully:

- The body of the pattern must be completely within the range of its preceding candle’s body (called “shadow”).

- There should be no upper shadow line at all (this would make it an inverted hammer).

- There should be no lower shadow line at all (this would make it a bullish engulfing).

It can be used in trading to signal a potential market reversal. It is particularly relevant when analyzing a trading pair, which refers to two different assets that are being traded against each other, such as Bitcoin and Ethereum as well as ETHUSDT or Ethereum against tether.

Dark Cloud Cover pattern can be incorporated into a bot trading strategy to automate trading decisions. The bot can be programmed to identify this pattern and execute trades accordingly based on predetermined rules and parameters. This allows for more efficient and consistent trading, as the bot can monitor the market and execute trades automatically.

How to Identify a Dark Cloud Cover Pattern

When identifying the pattern in your trading platform, there are several things to look for:

- The location of the cloud cover. This can be either at the top or bottom of an uptrend or downtrend. The direction of movement is also important as it indicates whether or not you should be looking to buy or sell.

- The candlestick that forms after the cloud cover forms. This will provide further confirmation as well as give you an idea about how long it will take for price action to move into a new direction after this pattern has completed itself (i.e., after price moves beyond where it was when the first candlestick formed).

- Your time frame–it’s important not only because it affects how far out into future time periods you’ll be able to see this pattern but also because if there are any other patterns happening simultaneously with yours (like double tops/bottoms), knowing what time frame they’re occurring on can give some extra insight into what might happen next.

Pattern Criteria

The dark cloud cover pattern is a reversal pattern, meaning that it indicates the potential for an upcoming trend change. The pattern consists of a long white candlestick followed by a black candlestick that gaps below the previous candlestick. The body of the second candlestick must be at least twice as large as the body of its predecessor, so there should be at least two days between them if you want to use this pattern successfully.

The dark cloud cover is similar to other reversal patterns like hammers and haramis because they all share similar characteristics: long shadows (shadows longer than bodies), no upper wicks (upper wicks are absent or very small) and no lower shadows (lower shadows are absent).

Price Action/Context

When you are trading the Dark Cloud Cover pattern, it is important to understand that price action is not reliable.

The context of the market will determine whether or not this pattern will appear and what price action means when it does.

For example, if Bitcoin (BTC) has been trending down for weeks and suddenly reverses course with a breakout above its 200-day moving average, then this would be seen as bullish confirmation of an uptrend in BTC’s price action. However, if this same breakout happens after several days of choppy sideways trading between two horizontal lines at $4k and $4200 respectively, then traders may opt not use any signals based on these patterns until they see more evidence that one direction or another is more likely than another.

Factors To Consider in Trading Using the Dark Cloud Cover pattern

Here are some factors to keep in mind when analyzing and trading with the Dark Cloud Cover pattern:

Market Context: Evaluate the overall market trend or context in which the Dark Cloud Cover pattern is forming. Consider the broader market conditions, such as the overall trend direction, major support and resistance levels, and the presence of any significant news or events that may impact the market.

Confirmation: Wait for confirmation before entering a trade based on the Dark Cloud Cover pattern. Confirmation can come in the form of a bearish candlestick that closes below the midpoint of the preceding bullish candlestick or a subsequent decline in price.

Volume: Analyze the trading volume during the formation of the Dark Cloud Cover pattern. An increase in volume can support the validity of the pattern and signal a stronger potential trend reversal.

Support and Resistance Levels: Consider the presence of any key support and resistance levels near the Dark Cloud Cover pattern. These levels can act as potential areas of price reversal, adding more weight to the pattern’s effectiveness.

Timeframe: Pay attention to the timeframe you are examining when identifying the Dark Cloud Cover pattern. The significance and strength of the pattern may vary depending on the duration of the candlestick chart you are analyzing. Consider using multiple timeframes to get a broader perspective.

Additional Technical Indicators: Combine the Dark Cloud Cover pattern with other technical indicators to confirm the potential reversal. Popular indicators like moving averages, RSI, MACD, or trendlines can provide additional insights and strengthen your trading decision.

Risk Management: Implement proper risk management strategies, such as setting stop-loss orders, defining your risk-reward ratio, and determining your position size. This is crucial to protect your capital and manage potential losses.

How to Trade the Dark Cloud Cover Pattern

Here’s some information on how to trade the Dark Cloud Cover pattern:

Spot the Pattern: Identify the Dark Cloud Cover pattern during an uptrend. The pattern consists of two candlesticks, starting with a long bullish candlestick, followed by a bearish one that opens above the high of the first candle but closes below its midpoint.

Wait for Confirmation: Don’t rush to take action based solely on the pattern. Wait for confirmation in the form of a bearish candlestick or a decline in price before entering a trade based on the Dark Cloud Cover pattern.

Consider the Market Context: Analyze the overall market context in which the pattern is forming. Factors such as the broader market conditions, key support and resistance levels, and trading volume are essential elements to consider.

Set Stop Loss Orders: Consider implementing proper risk management strategies, such as setting stop-loss orders, defining your risk-reward ratio, and determining your position size. This is crucial to protect your capital and manage potential losses.

Combine with Other Indicators: Combine the Dark Cloud Cover pattern with other technical indicators such as moving averages, RSI, MACD, or trend lines to confirm the potential reversal. This can provide additional insights and strengthen your trading decision.

Is the Dark Cloud Cover Pattern Reliable?

The reliability of the Dark Cloud Cover pattern can vary depending on various factors and market conditions. It is considered a bearish reversal pattern and is used by traders to identify potential trend reversals.

To increase the reliability of trading with the Dark Cloud Cover pattern, it is recommended to consider other factors such as market context, confirmation signals, trading volume, and the use of other technical indicators or analysis techniques.

Always remember that no trading pattern or strategy is 100% reliable, and it is crucial to use proper risk management techniques and to analyze multiple factors before making trading decisions.

Conclusion

To conclude, understanding candlestick patterns like the Dark Cloud Cover is an essential aspect of technical analysis in cryptocurrency trading. This pattern can help traders to anticipate market reversal and make informed trading decisions.

However, traders should not solely rely on such patterns, but should incorporate other technical analysis tools and fundamental analysis as well. With patience, careful analysis, and risk management, traders can maximize their profits and minimize their losses in the volatile world of cryptocurrency trading.